Outright gift of appreciated securities

Securities and mutual funds that have increased in value and been held for more than one year are one of the most popular assets to use when making a gift to Liberty Hospital Foundation. Making a gift of securities or mutual funds to us offers you the chance to support our work while realizing important benefits for yourself.

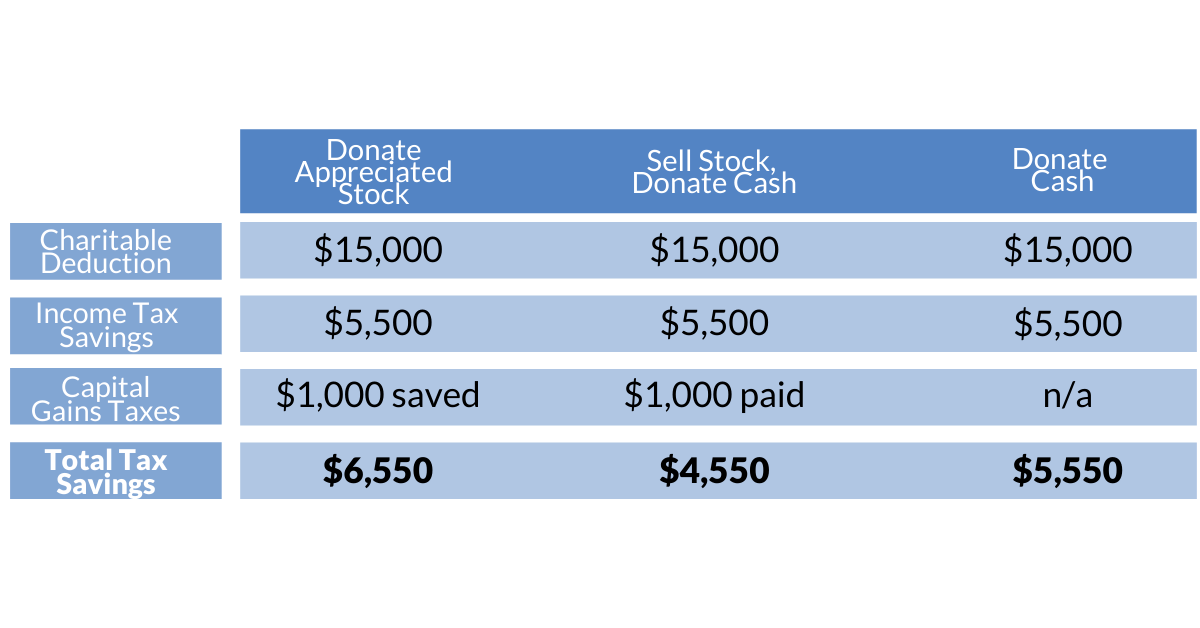

When you donate appreciated securities or mutual funds you have held more than one year to us in support of our mission, you can reduce or even eliminate federal capital gains taxes on the transfer. You may also be entitled to a federal income tax charitable deduction based on the fair market value of the securities at the time of the transfer. Assuming your marginal income tax rate is 37% and your long-term capital gain rate is 20%, take a look below for a couple scenarios and their tax implications.

Next steps

- Contact the Foundation at Foundation@Libertyhospital.org for additional information.

- Review and complete this form so that we can better understand your giving preferences.

- Seek the advice of your financial or legal advisor.